Payment Form and Application for Extension of Time to File Qualified Regenerative Manufacturing Company (QRMC) ReportĬover Sheet for Qualified Regenerative Manufacturing Company (QRMC) Federal ReturnĬombined Group Business Tax Apportionment Qualified Regenerative Manufacturing Company (QRMC) Election Qualified Investment Company (QIC) Report

Qualified Investment Company (QIC) Election If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920. To request forms, please email or call the Forms Line at (603) 230-5001.

#Filing a 1065 tax return how to#

Adobe provides information on how to adjust your browser settings to view PDFs. January 1, 2021, filers of Form 1065-X may need to include amended Schedules K-2 and K-3 (Form 1065). to abate the penalty for failing to file Form 1065, U.S.

#Filing a 1065 tax return pdf#

Please follow the above directions and use a different PDF Reader. Note for Apple users: Apple Preview PDF Reader does not support calculations in forms. Print the form using the 'Print Form' button on the form for best results

#Filing a 1065 tax return free#

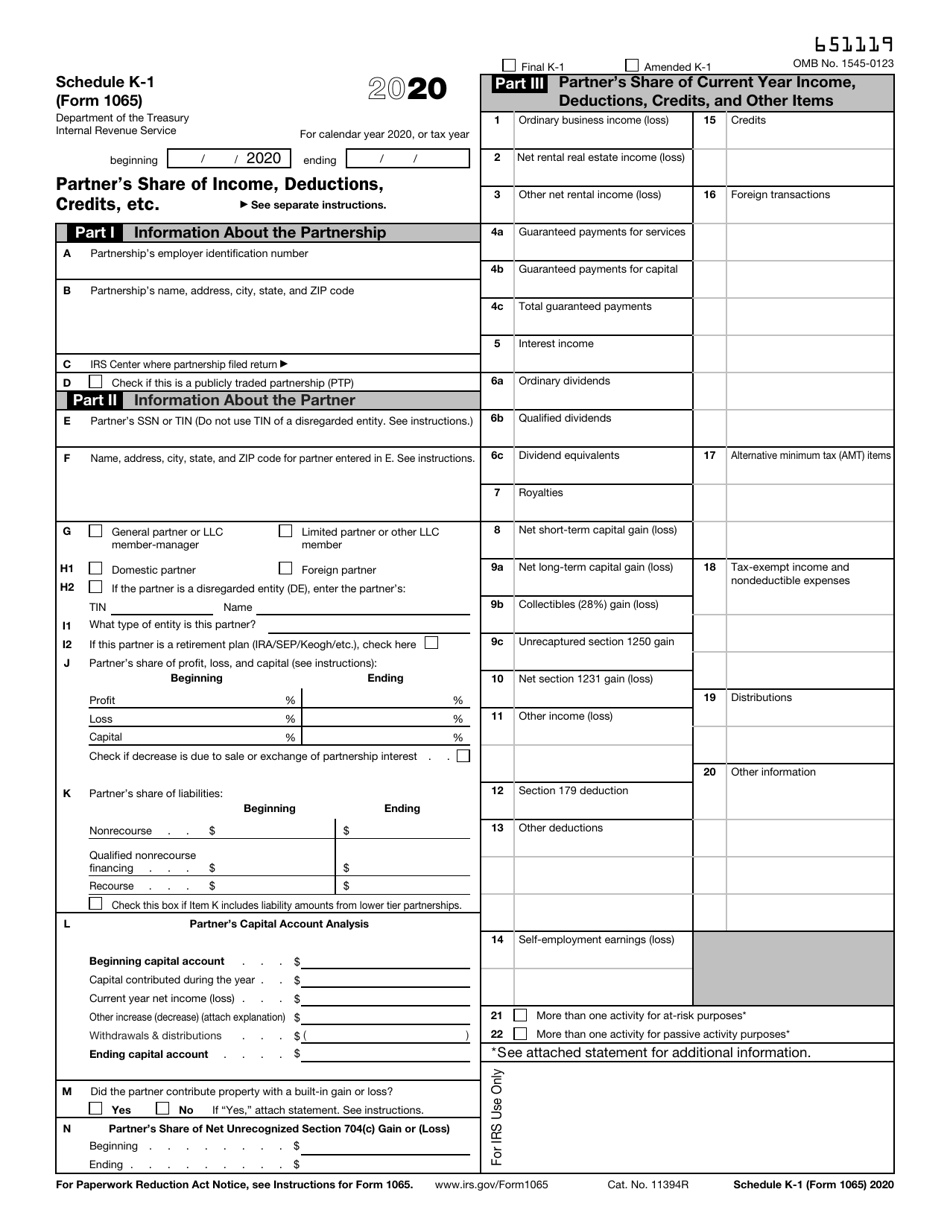

(Adobe's Acrobat Reader is free and is the most popular of these programs.)ĥ. or 1041: partnerships generally must file Form 1065. Open the form using a PDF Reader that supports the ability to complete and save PDF forms. 2020 estimated tax payments and amount applied from 2019 return STATEMENT 3. Choose a location to save the document and click "Save."Ĥ. A Schedule K-1 (Form 1065) tax form reports on a partners share of the income, deductions, credits and more of their business. Select “Save Target As” or “Save Link As.”ģ. When filing Iowa individual income tax returns, all partners must report all partnership income that is reportable on the partners federal return on the IA. Right click on the title link of the form you want to save.Ģ. You may also save the form as a PDF to your computer, complete the form, and then print and mail the form to the address listed.ġ. Maximize your deductions and save time with various imports & reports. To achieve the best results, we recommend the latest version of both your web browser and Adobe Acrobat Reader. Easy Guidance & Tools for Partnership & Multi-Member LLC Tax Returns.An alternative print version of most forms are available that have limited functionality but may be easier to open.The following forms are fillable PDF forms which can be opened, completed, and saved.To sort forms by "Form Number" or "Name/Description", click on that item in the table header.

0 kommentar(er)

0 kommentar(er)